Pumpenfabrik Wangen, a manufacturer of cavity and screw pumps, appoints a new Managing Director and CEO: As of November 2, 2020, Claus Garnjost will lead the company based in Wangen,

Germany. CEO Markus Hofheinz has left the company to pursue new professional opportunities.

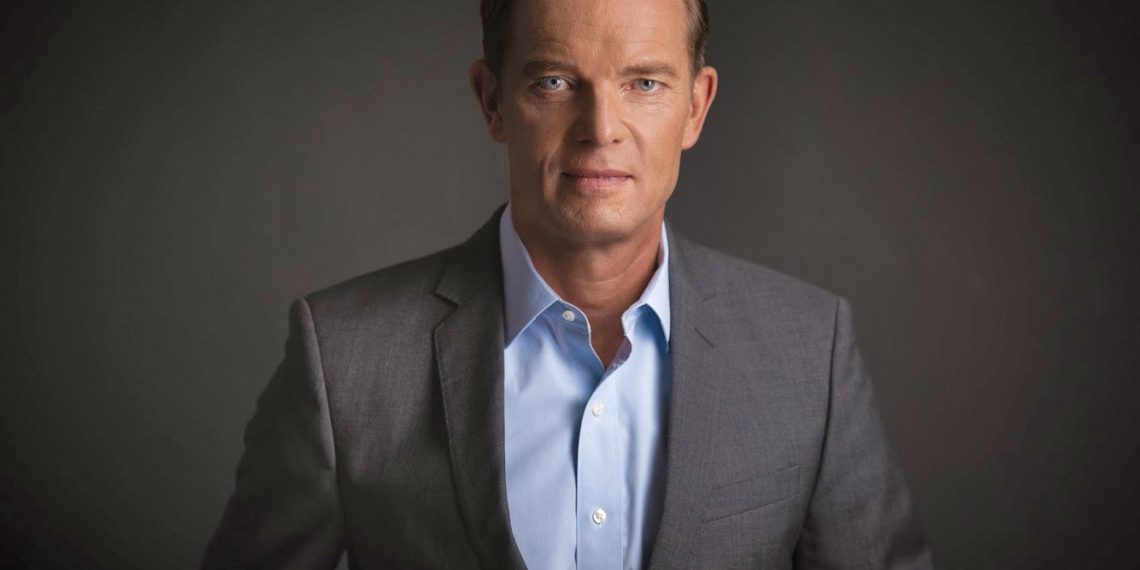

With Claus Garnjost (58), WANGEN PUMPEN gains an experienced and well-connected manager for the mechanical and plant engineering sectors. Before joining Pumpenfabrik Wangen, Garnjost was responsible for the strategic development of Leistritz AG, a 2000-strong producer of screw pumps, turbine parts, extrusion systems as well as machine tools and other tools, as both CTO/COO and Board Member. Previously Garnjost served as CEO for Gildemeister Drehmaschinen (a subsidiary of DMG MORI), and as COO for Gebr. Heller Maschinenfabrik and Coperion Werner & Pfleiderer.

He holds a degree in engineering and began his career at MAN Roland Druckmaschinen AG.

Together with CFO Lorenz von Haller, the extended management, the shareholders and all employees, Garnjost will continue on Pumpenfabrik Wangen’s current growth trajectory and continuously expand into new areas fit for strategic growth.

Shareholders and workforce of Pumpen Wangen express their thanks to Mr. Hofheinz for his services over the past two and a half years and wish him all the best in his future endeavours.