Merck, a science and technology company, held its 24th Annual General Meeting today at the Jahrhunderthalle in Frankfurt am Main. After Stefan Oschmann, Chairman of the Executive Board and CEO of Merck KGaA, briefly recapitulated the anniversary year 2018, he presented the company’s plans for future growth to Merck shareholders.

“Science and technology are transforming our world at lightning speed and we at Merck are helping to shape this transformation. Science is at the heart of everything we do,” said Oschmann. “We performed well in 2018, which was a challenging year. In 2019, we want to resume growth for all key figures: sales, EBITDA pre and EPS pre. Our objectives are ambitious yet feasible since we’ve created a solid foundation.”

As already reported in early March, Merck generated net sales in 2018 of € 14.8 billion, an increase of 2.2%. EBITDA pre, the company’s most important earnings indicator, declined by ‑10.5% to € 3.8 billion. This was largely due to negative exchange rate effects. Earnings per share pre (EPS pre), which is decisive for the Merck dividend, decreased in 2018 by ‑13.9% to € 5.10. Nevertheless, in the interests of dividend continuity, Merck is proposing to the Annual General Meeting a dividend of € 1.25 per share as in the previous year. As previously announced, Merck expects moderate organic growth of Group sales in 2019. For EBITDA pre, the company forecasts a pronounced organic percentage increase in the low teens range in 2019.

The company has also clearly formulated its long-term objectives and is resolutely focusing on them. In the Healthcare business sector, as of 2022 Merck aims to achieve around € 2 billion in sales annually with newly launched medicines or compounds still in its Biopharma pipeline at the present time. In 2018, Merck generated sales of € 160 million with its two new medicines, the immuno-oncology drug Bavencio and Mavenclad for the treatment of multiple sclerosis. At the end of March 2019, Mavenclad was approved by the U.S. Food and Drug Administration (FDA) and thus in the largest single regional market for this medicine.

The firm has also filed for further approvals of Bavencio. The regulatory authorities in the United States, Europe and Japan are reviewing Bavencio in combination with Inlyta from Pfizer in the treatment of patients with advanced renal cell carcinoma. In addition, an important element of Merck’s strategy in the Healthcare sector is the alliance entered into in February with GlaxoSmithKline to co-develop and co-commercialize bintrafusp alfa (M7824), an immunotherapy from Merck currently in clinical trials. The agreement has a potential overall value of up to € 3.7 billion. Overall, eight clinical programs for this novel immunotherapy will be in progress or initiated this year.

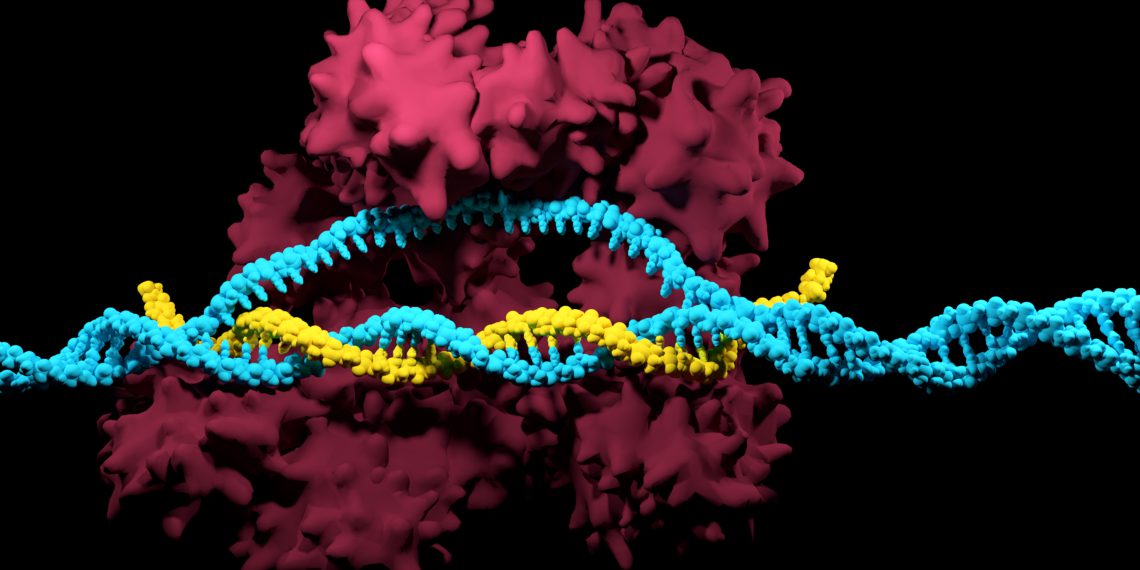

In its Life Science business sector, Merck intends to continue to achieve above-market growth. Merck sees great potential particularly for the business with pharmaceutical companies, which is the main focus of the Process Solutions business unit. E‑commerce is also playing an important role and already accounts for a large portion of Life Science sales. In addition, Merck is investing in growth fields such as bioprocessing technology for drug manufacturing. The company is forging ahead with promising new technologies, for example the BioContinuum platform. With BioContinuum, Merck wants to significantly simplify and accelerate the complex manufacturing process for biotech medicines by melding formerly separate steps into one continuous process for its customers in the coming years.

In Performance Materials, Merck intends to expand its position as a leading provider of solutions for the electronics industry. After 2019, the company is aiming to increase sales in this business sector by an average of 2% to 3% annually. On

April 12, Merck signed a definitive agreement to acquire Versum Materials for US$ 53 per share. The business combination is expected to significantly strengthen the Performance Materials business sector. The U.S. company Versum is one of the world’s leading suppliers of innovation-driven, high-purity process chemicals, gases and equipment for semiconductor manufacturing. The transaction is expected to close in the second half of 2019, subject to the approval of Versum stockholders at a Versum special meeting, regulatory clearances and the satisfaction of other customary closing conditions. “Versum will broaden our portfolio. Our competencies are highly complementary. Together, we can offer our customers more. This is very important because the digital revolution has only just begun and we want to considerably advance it further,” Oschmann said to shareholders.

Furthermore, Merck is also working to build new digital businesses beyond its three business sectors. The joint venture Syntropy, which Merck plans to establish with Palantir Technologies, wants to help scientists use scientific data better and securely. By enabling researchers to structure data from various sources and to analyze it via pattern recognition, Syntropy initially aims to considerably accelerate cancer research. Additionally, Syntropy will enable researchers to exchange and trace data reliably, with users always retaining full control of their data.