In the metal and electrical industry, 74 percent of all companies plan to increase their liquidity within the next twelve months. This is the result of a recent survey of 200 companies in the industry conducted by the financing specialist Close Brothers Factoring GmbH in Mainz. For a good four out of ten companies (44 percent), the way to more liquidity is through the sale and disposal of assets. Slightly fewer companies (42 percent) would like to sell assets and then rent or lease them back (sale-and-hire purchase or sale-and-lease-back). Just under a third of respondents (30 percent) also plan to achieve their goals by means of factoring.

One of the reasons for the preferred instruments is probably that for the respondents, independence from a bank (35.5 percent) and the positive impact on the equity ratio (33.5 percent) are among the three most important factors when choosing a financing solution.

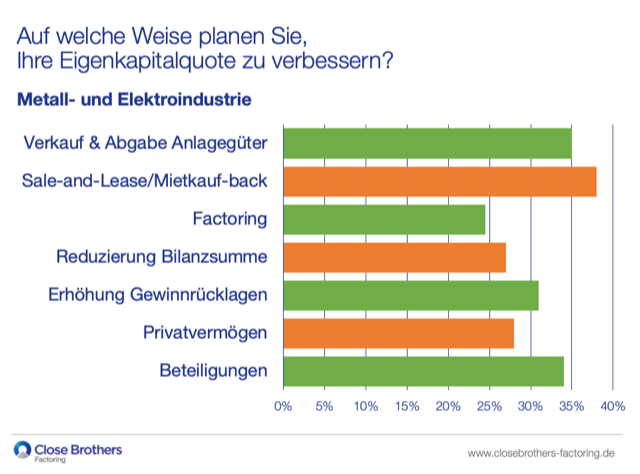

The picture is similar to that for liquidity when it comes to increasing the equity ratio. Almost three-quarters of all companies would also like to increase this (73.5 percent). The most popular solutions for this purpose are sale-and-lease-back or sale-and-hire-back models (38 percent), the sale and disposal of assets (35 percent) and equity investments (34 percent). Around a quarter (24.5 percent) would also like to achieve the goal using factoring.

“The survey reflects our experience that increasing one’s own liquidity and equity ratio are currently very important topics for a large majority of companies in the metal and electrical industry. We are very pleased that factoring is seen as an important instrument in this context. With our flat hierarchies, which we have as a subsidiary of a large British merchant bank, and the great experience of our team of employees, we can support interested parties with quick solutions.”

- Detlef Küßner, Managing Director