Now there is a fifth deal between Coherus BioSciences and Shanghai Junshi Biosciences for Junshi’s PD‑1 inhibitor named Tuoyi (toripalimab), the US or EU companies and Chinese PD‑1/L1 developers. With six checkpoint inhibitors originally developed in China and now partnered with the US/EU companies vying for approval in the US, this could lead to aggressive discounted prices and competitive pressure on the established checkpoint inhibitors, shaking up the US market in coming years, says GlobalData, a leading data and analytics company.

Jessica McCormack, PhD, Oncology and Hematology Analyst at GlobalData, comments: “When Chinese PD‑1 inhibitors Tuoyi and Tyvyt (sintilimab) (from Innovent/Eli Lilly), launched in China they did so at considerably lower price points than rival PD‑1 inhibitors, Keytruda and Opdivo. A similar cut in pricing in the US market could see new entries from China really starting to compete with the big names. Looking ahead, this strategy could be even more successful in more cost-conscious countries.”

All six of the checkpoint inhibitors that have partnerships with the US/EU firms are in late stage development and come with some compelling clinical data. Tuoyi is already approved in China for the treatment of second line melanoma patients and also comes with both breakthrough therapy and orphan designations for nasopharyngeal cancer, and orphan designation for soft tissue sarcoma. Tyvyt is in a similar position, having been approved in China in 2019 for third line relapsed or refractory classic Hodgkin’s lymphoma. The company demonstrated positive results in a Phase III trial in non-small cell lung cancer (NSCLC) in China. However, its US-based Phase III trial is exploring Tyvyt in esophageal cancer.

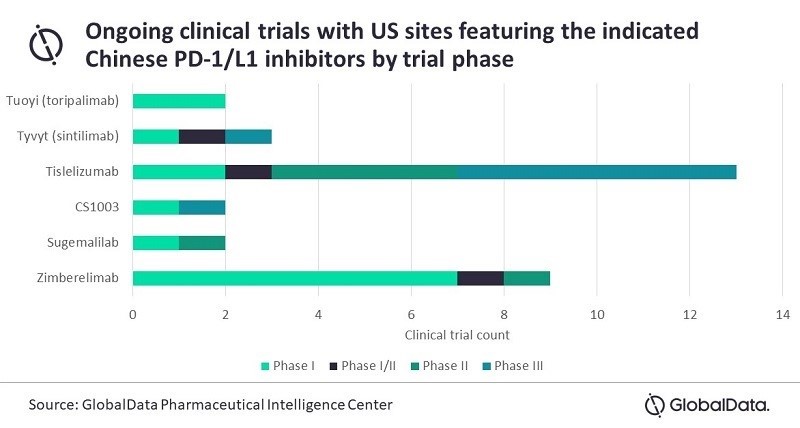

McCormack continues: “Coherus and Junshi have indicated that they intend to file a Biologics License Application for the use of Tuoyi in nasopharyngeal cancer later this year. While the US trials are now underway, the majority of clinical data will be coming from Asia and it remains to be seen how the FDA will handle this. The most advanced candidate is tislelizumab. Originally developed by BeiGene and now partnered with Novartis, there are currently 13 US-based clinical trials featuring tislelizumab, including six in Phase III, so this could be a good bet for a first US approval.”

Positive interim results with tislelizumab have been reported from both the Rationale 302 and Rationale 303 trials in previously treated esophageal and NSCLC patients, respectively. BeiGene has indicated that an FDA filing is likely in the near term, though it is not known which indication will be pursued first.

McCormack concludes: “NSCLC is dominated by Merck’s Keytruda (pembrolizumab). In contrast, Keytruda and Bristol Myers Squibb’s Opdivo (nivolumab) were approved recently for esophageal cancer. This could make this relatively small indication a more appealing initial approval for BeiGene and pave the way for other Chinese-made PD‑1 inhibitors to enter the US market.”

Biogas technologies for production of biomethane

The untapped feedstock potential for biomethane production in Spain is very large as the country has a very strong food...

Read more